Candlestick designs are more than fair visual representations of cost developments; they reflect the collective feelings, considerations, and choices of dealers within the budgetary markets. Each design offers see-into-the-brain research of the showcase, uncovering whether fear, eagerness, certainty, or instability is driving exchanging decisions.

In this article, we’ll investigate the brain research behind candlestick designs, get how they capture advertise opinion and talk about how traders can utilize this information to upgrade their exchanging methodologies. We’ll also highlight key instruments and stages like Radix Trading, the significance of opening a web share exchanging account, and the benefits of utilizing MetaTrader 4 Webtrader.

Understanding Candlespick: A Profound Jump into Market Sentiment

The term candlespick is frequently utilized to portray the cautious choice and examination of candlestick designs by dealers to form educated choices. These designs are a crucial portion of the specialized examination, advertising bits of knowledge into potential advertise developments based on past cost information.

Understanding how to candlestick successfully requires not as it were information about the designs themselves but moreover mindfulness of the fundamental advertising assumption that drives these designs.

The Essentials of Candlestick Designs

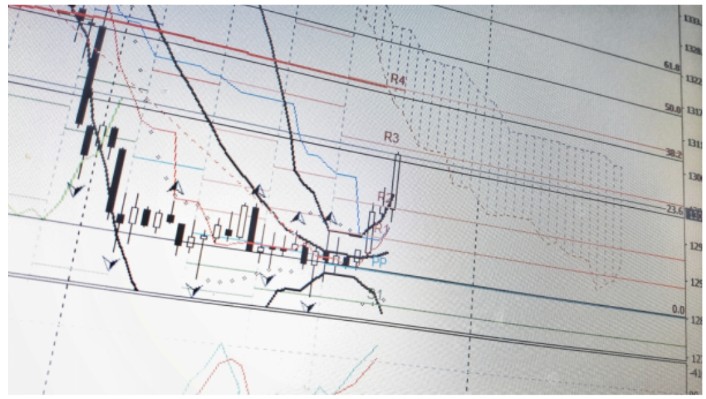

Sometime recently plunging into the mental viewpoints, it’s basic to get it what candlestick designs speak to. A single candlestick gives data around the opening, closing, tall, and moo costs within a particular time outline. The body of the candlestick reflects the toll expansion between the opening and closing costs, while the wicks (or shadows) talk to the highs and lows.

Candlestick plans are molded by one or more candlesticks and are categorized into bullish and bearish candlestick patterns. Bullish designs recommend that costs are likely to rise, whereas bearish designs demonstrate potential descending developments. Dealers who get these designs can better foresee future cost developments and create successful exchange procedures.

The Brain Research Behind Candlestick Designs

Candlestick designs are not just irregular arrangements on a chart; they are the result of the feelings and behaviors of advertising members. Understanding the psychology behind these designs can give dealers profitable experiences in showcase estimation.

- The Doji Candlestick: An Image of Showcase Uncertainty

The Doji candlestick design happens when the opening and closing costs are about indistinguishable, coming about in a little or non-existent body. This design reflects uncertainty within the showcase, where neither one nor the other buyers nor dealers have the upper hand.

- Bullish Inundating Design: A Move-in Showcase Estimation

The Bullish Overwhelming design is shaped when a little bearish candle is taken after by a bigger bullish candle that immerses the past one. This pattern demonstrates a move in advertising assumption from bearish to bullish.

- Bearish Inundating Design: A Caution of Approaching Decrease

Alternately, the bearish candlestick patterns comprise a little bullish candle taken after by a bigger bearish candle that overwhelms the previous one. This design recommends that buyers have misplaced control, and dealers are picking up quality.

Showcase Opinion: The Driving Constrain Behind Candlestick Designs

Advertise sentiment refers to the general disposition or state of mind of financial specialists toward a specific resource or the showcase as an entire. This assumption is affected by different components, including financial information, news occasions, and geopolitical advancements.

Understanding advertising opinion is vital for traders, and devices like Radix Trading can give important bits of knowledge by analyzing advertising information and identifying shifts in estimation

The Significance of a Solid Exchanging Stage

To successfully exchange utilizing candlestick patterns, it’s basic to have a solid exchanging stage. open online share trading account gives you access to different markets and budgetary rebellious, permitting you to apply your information of candlestick designs in real-time.

One well-known stage among traders is MetaTrader 4 Webtrader. This stage offers progressed charting instruments, and counting candlestick charts, which are significant for specialized examination. With MetaTrader 4 Webtrader, dealers can effectively switch between diverse time outlines, apply specialized markers, and indeed mechanize their exchanging strategies

Ultimately

Understanding the psychology behind candlestick designs could be an effective apparatus for any dealer. These designs are not fair arbitrary arrangements on a chart; they are the result of collective human feelings and behaviors. Devices like Radix Trading and stages like Metatrader 4 Webtrader can advance and improve your exchanging encounter by providing the necessary assets to analyze and act on candlestick patterns.